aurora sales tax rate 2021

The December 2020 total local sales tax rate was also 8250. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax.

Capital Gains Tax Calculator 2022 Casaplorer

Note that failure to.

. The minimum combined 2022 sales tax rate for Aurora New York is. Ad Lookup Sales Tax Rates For Free. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent.

The City of Auroras tax rate is 9225 and is broken down as follows. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Youll find rates for sales and use tax motor vehicle taxes and lodging tax.

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. The Aurora sales tax rate is. This increase and extension became.

While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected. 2021 Colorado State Sales Tax Rates The list below details the localities in Colorado with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Did South Dakota v.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Timely filers are entitled to a 21 discount.

This web page contains changes to existing sales or use tax rates. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail sale delivered by motor vehicle to a location within Colorado. The Aurora Illinois sales tax is 625 the same as the Illinois state sales tax.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Tax Rate Changes Modifications. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. 2021 Tax rates for Cities Near Aurora. Sales Use Tax Rate Changes Effective July 1 2022.

Effective January 1 2007 the Adams County Sales Tax rate increased from 07 percent to 075 percent. Go to the Retail Delivery Fee web page for information on how to begin collecting and remitting. The County sales tax rate is.

This clarification is effective on June 1 2021. The Colorado sales tax rate is currently. Aurora 44202 Portage 700.

Aurora property tax rates are the 9th lowest property tax rates in Ontario for municipalities with a population greater than 10K. Birmingham Alabama at 10 percent rounds out the list of. City of Aurora 25.

The total sales tax rate for restaurants is 933 and 943 for hotellodging establishments. Aurora took a major step Monday toward eliminating the citys sales tax on menstrual products putting it in line to. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The December 2020 total local sales tax rate was also 8000. The current total local sales tax rate in Aurora IL is 8250.

Aurora Sales Tax Rates for 2022. There is no applicable county tax. What is the sales tax rate in Aurora Colorado.

Wayfair Inc affect New York. POST OFFICE ZIP CODE COUNTY RATE POST OFFICE ZIP CODE COUNTY RATE PAGE 2 REVISED January 1 2021 Dennison 44621. What is the sales tax rate in Aurora New York.

This is the total of state county and city sales tax rates. Effective December 31 2011 the Football District salesuse tax. Five other citiesFremont Los Angeles and Oakland California.

The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities. 388 - City and MRD 358 City and 3 MRD 175 - Montrose County. On November 2 2004 voters approved a ballot issue to increase the existing Open Space Sales Tax from 02 percent to 025 percent and extend the tax until December 31 2026.

You can print a 85 sales tax table here. Aurora-RTD 290 100 010 025 375. Filing after the due date will result in the loss of the discount plus the assessment of a penalty of 75 and interest at 125 per month.

Note that the State of Colorado has enacted the same clarification. You can print a 825 sales tax table here. Did South Dakota v.

Best 5-Year Variable Mortgage Rates in Canada. And Seattle Washingtonare tied for the second highest rate of 1025 percent. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

This is notan all inclusive list. March 8 2021 at 745 pm. Wayfair Inc affect Colorado.

This is the total of state county and city sales tax rates. Look up a tax rate. The County sales tax rate is.

Wednesday July 01 2020. For tax rates in other cities see Colorado sales taxes by city and county. The Aurora sales tax rate is.

Interactive Tax Map Unlimited Use. The Aurora Sales Tax is collected by the merchant on all qualifying sales. Recent Colorado statutory changes require retailers to charge collect and remit a new fee.

City Final Tax Rate. The minimum combined 2022 sales tax rate for Aurora Colorado is. March 8 2021 at 748 pm.

Friday January 01 2021. 275 lower than the maximum sales tax in IL. The City Code also requires that payment of the tax be made before the end of the month following the monthperiod for which the tax has been filed.

This page does not contain all tax rates for a business location. To find all applicable sales or use tax rates for a specific business location or local government visit the How to Look Up Sales Use Tax Rates web page. The current total local sales tax rate in Aurora CO is 8000.

For tax rates in other cities see Illinois sales taxes by city and county. The sales and use tax rates for retail sales in the city are. 24 lower than the maximum sales tax in CO.

Search by address zip plus four or use the map to find the rate for a specific location. Use the Colorado Tax Rate Lookup Tool to find rate information for any address in Colorado. The New York sales tax rate is currently.

Austinburg 44010 Ashtabula 675.

Aurora Kane County Illinois Sales Tax Rate

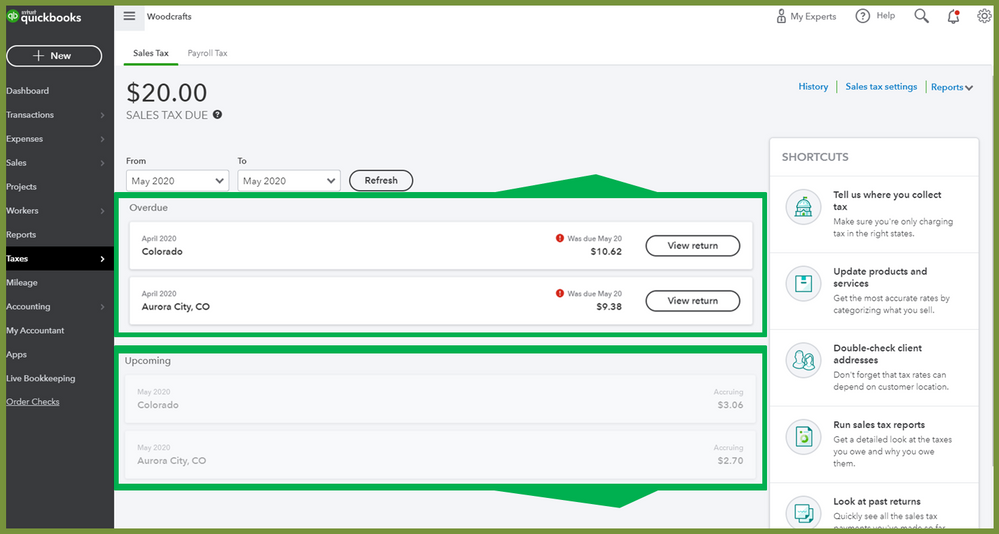

Set Up Automated Sales Tax Center

Kansas Sales Tax Rates By City County 2022

Winnipeg Property Tax 2021 Calculator Rates Wowa Ca

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Cannabis Taxes At Your Dispensary

Colorado Sales Tax Rates By City County 2022

Governors Cannot Stop Inflation But Tax And Regulatory Reform Will Boost Their States Economies

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

Nebraska Sales Tax Rates By City County 2022

Set Up Automated Sales Tax Center

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute